Sequoia IndiaSeries 1

Sequoia India Series 1

Sequoia India Series offer investors the ability to gain 100% leveraged exposure to the performance the MSCI India Excess Return 0.90% Decrement Index. This index references the MSCI India Index, which is a market cap weighted index designed to measure the performance of the large and mid cap segments of the Indian equity market.

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

Sequoia India Series offer investors the ability to gain 100% leveraged exposure to the performance the MSCI India Excess Return 0.90% Decrement Index. This index references the MSCI India Index, which is a market cap weighted index designed to measure the performance of the large and mid cap segments of the Indian equity market.

Summary of the key features

The MSCI India Excess Return 0.90% Decrement Index (Bloomberg code: MXINER9D Index) is an excess return index designed to track the extent to which the performance of the underlying MSCI India Index (Bloomberg code: M1IN Index) exceeds the USD secured overnight financing rate (Bloomberg code: SOFRRATE) rate after deducting a fee of 0.9% p.a.

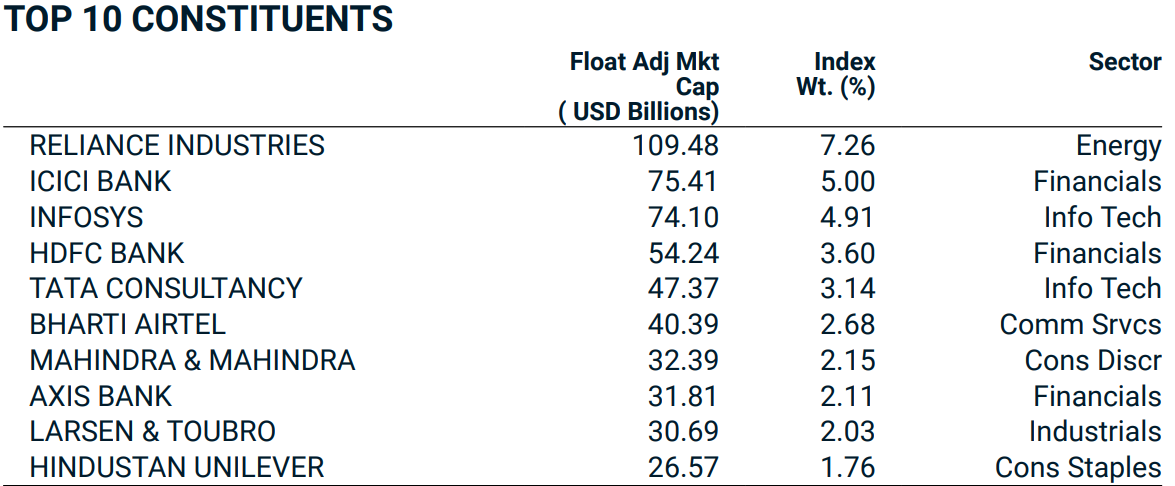

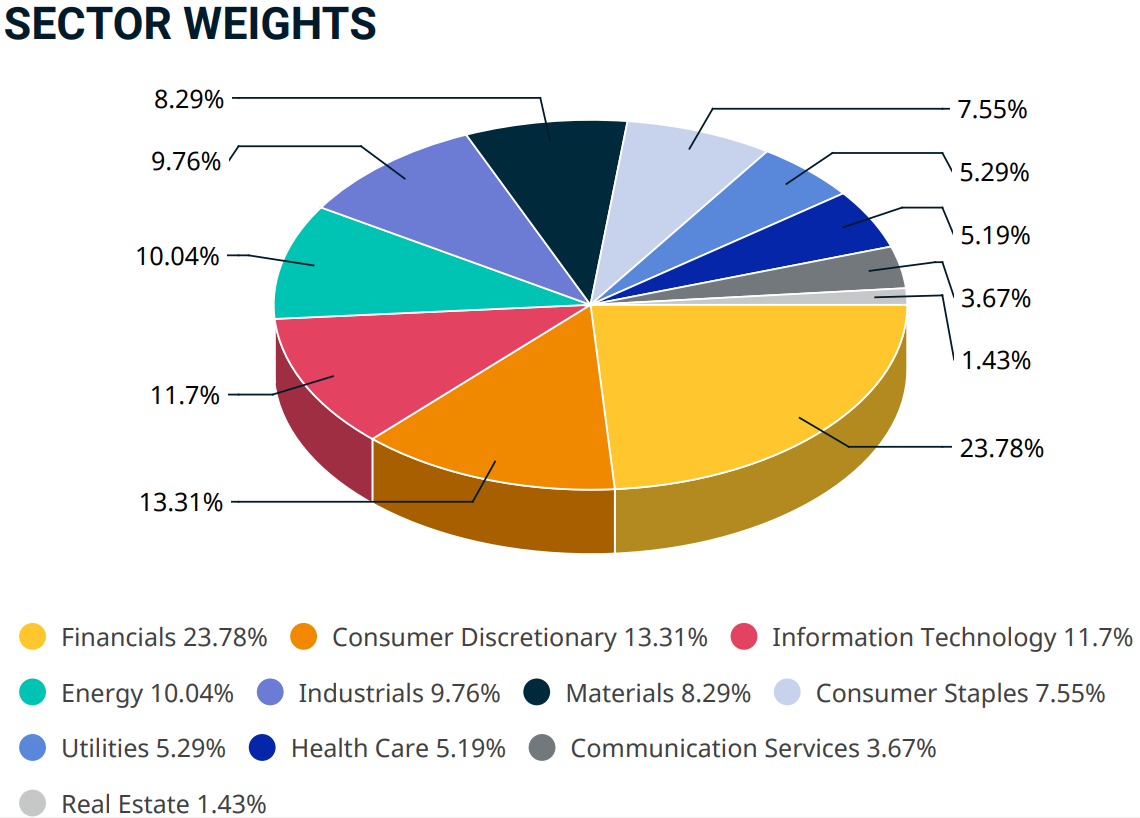

The underlying MSCI India Index (M1IN Index) is a market cap weighted index designed to measure the performance of the large and mid cap segments of the Indian equity market. At the time of writing this PDS, it covers approximately 85% of the Indian equity universe, containing 146 stocks. It is denominated in USD and is calculated on a net total return basis i.e. it includes dividends after deducting any withholding taxes. There is no currency hedging included which means that it’s performance is impacted not just by stock price movements but also movements in the USD/INR exchange rate.

The 0.9% p.a. fee is included in the calculation of the MXINER9D Index as an estimate of the implied repo rate included in the pricing of the Indian equity futures market such as NIFTY 50 futures (Bloomberg ticker: “JGSA Index”). This is included on a best efforts basis to align the economic exposure of the MSCI India Excess Return 0.90% Decrement Index as closely as possible with the original Reference Asset (The Barclays India ER Tracker Index (“BXIIINER Index”)) where this fee was effectively included.

Investors should be aware that the interest cost on a limited recourse loan provided for an investment linked directly to the MSCI India Index (M1IN Index) would be approximately 13.1% p.a. or 4.5% p.a. higher than the interest payable under Sequoia India Series 1 (linked to the MSCI India Excess Return 0.90% Decrement Index (Bloomberg code: MXINER9D Index)). This is because the hedge cost obtained from the Hedge Counterparty is significantly lower due to the fact that Series 1 is referencing an index which is an excess return index and its calculation includes a deduction for the USD secured overnight financing rate and an estimate of the implied repo rate. As such, Series 1 is a lot more cost efficient for end investors.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Term Sheet PDS and Master PDS, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key risks include:

- Risk of 100% loss in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. A 100% loss will occur if there is no Semi-Annual Performance Coupon paid by Maturity. This will be the case if the Index Performance is less than or equal to zero on the Maturity Date;

- Risk of partial loss (i.e. less than 100% loss) in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. Investors may incur a partial loss if the sum of all Semi-Annual Performance Coupons at Maturity is less than the Break-Even Point;

- Timing risks. The timing risk is significant. This is because the Investment Term is fixed and the sum of all Semi-Annual Performance Coupons received by the Maturity Date needs to exceed the Total Investment Cost in order for the investor to generate a profit from their investment (ignoring any Upfront Adviser Fee and any external costs). If this does not occur by the Maturity Date then Investors will generate a loss;

- The Semi-Annual Performance Coupons are determined by reference to the Index Performance as well as the change in the AUD/USD exchange rate during the Investment Term. An increase in the AUD/USD exchange rate between the Commencement Date and the Maturity Date will reduce any potential Semi-Annual Performance Coupons payable (if any) whilst a decrease in the AUD/USD rate between the relevant dates will lead to an increase in the potential Semi-Annual Performance Coupons payable (if any). As such, whether or not you break-even depends on both the Index Performance and the AUD/USD exchange rate performance during the Investment Term;

- Volatility and exposure risk – the volatility control mechanism used by the Index means that if there is high volatility in the relevant underlying portfolio during the Investment Term there is a risk the Index will have little to no exposure to this portfolio during some or all of the Investment Term, which may provide some protection against decreases in the prices of the portfolio comprising the Index however it may also limit the Index’s (and the Units’) exposure to increases in the prices of the relevant portfolio comprising the Index. To the extent the Index has an exposure primarily to cash as a result of the volatility control mechanism, the Index will be unlikely to generate the Index Performance required for investors to generate a profit;

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and Fees, during the Investment Term;

- Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event, you will not receive a refund of your Prepaid Interest or Fees. The amount received will depend on the market value of the Units which will be determined by many factors before the Maturity Date including prevailing interest rates in Australia and internationally, foreign exchange rates, the remaining time to Maturity, and general market risks and movements including the volatility of the Index. Investors should be aware the Units are designed to be held to Maturity and are not designed to be held as a trading instrument;

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a limited recourse Loan, so you can never lose more than your Prepaid Interest Amount and Fees paid at Commencement.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty; and

- the Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 2 “Risks” of the Master PDS for more information.

Units in Sequoia Alpha Series 5 are issued by Sequoia Specialist Investments Pty Ltd (ACN 145 459 936) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN 135 907 550, AFSL 341506) (the “Arranger”). Investments in the Sequoia Alpha Series 5 can only be made by completing an Application Form attached to the Term Sheet PDS, after reading the Term Sheet PDS dated 1 August 2024, the Master PDS dated 17 August 2017 and Target Market Determination (for retail investors) and submitting it to Sequoia. A copy of the Termsheet PDS, Master PDS and Target Market Determination can be obtained by contacting Sequoia Asset Management or contacting your financial adviser. You should consider the Term Sheet & Master PDS’s as well as the Target Market Determination before deciding whether to invest in Units in Sequoia Alpha Series 5. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master PDS.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.