Sequoia Launch

Series 70

Sequoia Launch Series 70 - Barclays Multi-Asset Alternative Risk Premia Index

The Units in Launch Series 70 offer investors the ability to gain 100% leveraged exposure to the performance the Barclays Alternative Risk Premia Select RC 4% ER USD Index (“the Barclay’s Multi-Asset ARP Index”). This index is a cross-asset, multi-strategy index referencing a portfolio of Alternative Risk Premia (ARP) strategies.

The above index aims to perform positively under different market environments and deliver returns uncorrelated to traditional asset classes (e.g. equities and bonds).

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

Summary of the key features

Barclay’s Multi-Asset ARP Index

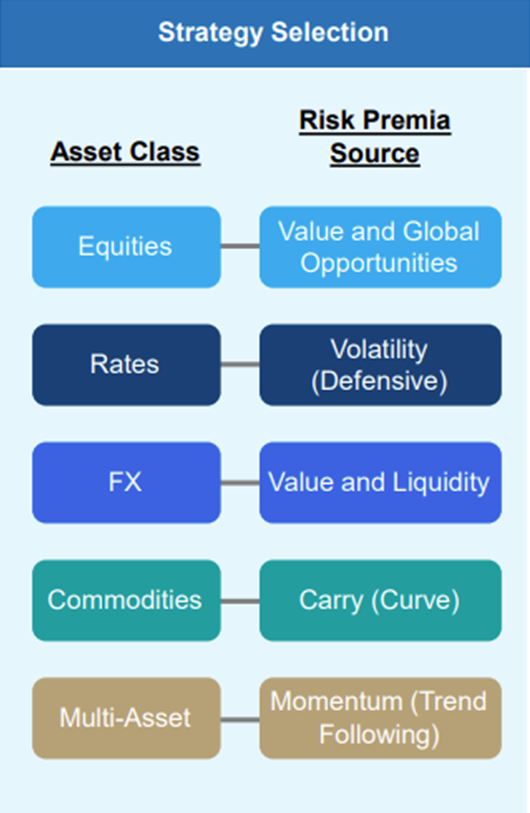

The Barclay’s Multi-Asset ARP Index aims to deliver positive performance under different market environments and seeks to generate returns uncorrelated to traditional asset classes. It consists of a portfolio of Barclay’s flagship Alternative Risk Premia (ARP) indices that have the objective of extracting risk premia from a variety of asset classes. It is constructed with robust risk management whereby the allocation between each strategy is based on equal risk contribution, along with 4% volatility control mechanism and 120% maximum exposure.

Volatility Control mechanism for the Barclay Multi-Asset ARP Index – Illustrative example

The 4% volatility control mechanism is a technique which dynamically adjusts exposure to underlying asset(s) based on the prevailing level of volatility. This potentially provides investors with more stable performance and reduced drawdowns whilst enabling a lower cost of hedging for the Issuer thereby enabling a lower interest rate.

If the recent volatility of the underlying portfolio of ARP strategies exceeds 4%, the target exposure will be less than 100%, and the residual weight will be uninvested. If the recent volatility of the underlying portfolio of ARP strategies is below 4%, the target exposure to underlying portfolio will be more than 100%, subject to max. leverage level of 120%.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Term Sheet PDS and Master PDS, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key risks include:

- Risk of 100% loss in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. A 100% loss will occur if there are no Performance Coupon is paid at Maturity. This will be the case if the Index Performance is less than or equal to zero on the Performance Coupon Date;

- Risk of partial loss (i.e. less than 100% loss) in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. Investors may incur a partial loss if the Performance Coupon received during the Investment Term is less than the Break-Even Point;

- Timing risks. The timing risk is significant. This is because the Investment Term is fixed and the Performance Coupon received at the end of the Investment Term needs to exceed the Total Investment Cost by the time the Maturity Date arrives in order for the investor to generate a profit from their investment (ignoring any Upfront Adviser Fee and any external costs). If this does not occur by the Maturity Date then Investors will generate a loss;

- The Performance Coupon at Maturity is determined by reference to the Index Performance as well as the change in the AUD/USD exchange rate during the Investment Term. An increase in the AUD/USD exchange rate between the Commencement Date and the Performance Coupon Date will reduce any potential Performance Coupon payable (if any) whilst a decrease in the AUD/USD rate between the relevant dates will lead to an increase in the potential Performance Coupon payable (if any). As such, whether or not you break-even depends on both the Index Performance and the AUD/USD exchange rate performance during the Investment Term;

- Volatility and exposure risk – the volatility control mechanism used by the Index means that if there is high volatility in the relevant underlying portfolio during the Investment Term there is a risk the Index will have little to no exposure to this portfolio during some or all of the Investment Term, which may provide some protection against decreases in the prices of the portfolio comprising the Index however it may also limit the Index’s (and the Units’) exposure to increases in the prices of the relevant portfolio comprising the Index. To the extent the Index has an exposure primarily to cash as a result of the volatility control mechanism, the Index will be unlikely to generate the Index Performance required for investors to generate a profit;

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and Fees, during the Investment Term;

- Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event, you will not receive a refund of your Prepaid Interest or Fees. The amount received will depend on the market value of the Units which will be determined by many factors before the Maturity Date including prevailing interest rates in Australia and internationally, foreign exchange rates, the remaining time to Maturity, and general market risks and movements including the volatility of the Index. Investors should be aware the Units are designed to be held to Maturity and are not designed to be held as a trading instrument;

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a limited recourse Loan, so you can never lose more than your Prepaid Interest Amount and Fees paid at Commencement.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty; and

- the Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 2 “Risks” of the Master PDS for more information.

Units in Sequoia Launch Series 70 are issued by Sequoia Specialist Investments Pty Ltd (ACN 145 459 936) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN 135 907 550, AFSL 341506) (the “Arranger”). Investments in the Sequoia Launch Series 70 can only be made by completing an Application Form attached to the Term Sheet PDS, after reading the Term Sheet PDS dated 8 September 2023, the Master PDS dated 17 August 2017 and Target Market Determination (for retail investors) and submitting it to Sequoia. A copy of the Termsheet PDS, Master PDS and Target Market Determination can be obtained by contacting Sequoia Asset Management on or contacting your financial adviser. You should consider the Term Sheet & Master PDS’s as well as the Target Market Determination before deciding whether to invest in Units in Sequoia Launch Series 70. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master PDS.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.